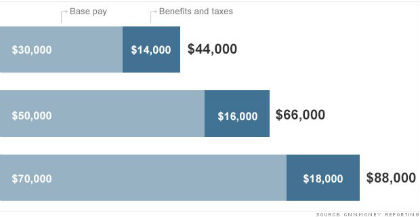

The average cost of hiring an employee depends on the employer sponsored health benefits, however the typical cost is 18% – 26% over the employee’s base salary. The figures are outlined below:

Employer Taxes

From Money.CNN.com 2013

- Social Security 6.2%

- Medicare 1.45%

- State Unemployment 4% (depending on the employer)

- Federal Unemployment 6% (minus a credit if the employer has paid into a state unemployment fund)

- Workers’ Compensation 1% (based on administrative employees)

Employer Paid Benefits

- Paid holidays, vacation, and sick days (average 10 holidays a year, one week vacation per year — sick days vary depending on policy)

- Pension Plan contributions

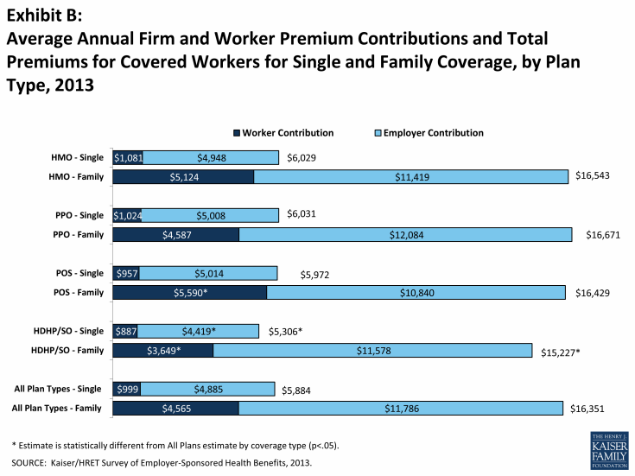

- Health benefits $6k – 11k per year

The Kaiser Family Foundation published a 2013 survey , which provides a detailed look at trends in employer-sponsored health coverage, including premiums, employee contributions, cost-sharing provisions, and other relevant information. The 2013 survey included almost three thousand interviews with non-federal public and private firms.